401k contribution calculator to max out

To max out a 401 for 2021 an employee would need to contribute 19500 in salary deferralsor 26000 if theyre over age 50. The IRS allows each person to contribute 19500 to their 401k account up until age 50.

Strategies For Contributing The Maximum To Your 401k Each Year

HOW TO CALCULATE YOUR 401K CONTRIBUTION AMOUNT MAX OUT 401K In the 2017 tax year the contribution limit per year per person was 18000 meaning you could.

. After age 50 you are able to contribute a total of 26000 each year. This federal 401k calculator helps you. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Compensation limit used to calculate contributions. Ad Discover The Benefits Of A Traditional IRA. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Take advantage of the increased limit and max out your 401k to get the most savings possible before you retire. How To Max Out A 401k For 2021 the 401k contribution limit is 19500 in salary deferrals.

Ad Help Determine Your IRA Contribution Limit With Our Tool. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

Some investors might think about maxing out. Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator. 401k Contribution Calculator To Max Out If you get paid twice per month that works out to be a total 401 k contribution of 800 per month or 9600 per year.

Learn About 2021 Contribution Limits Today. Ad Discover The Benefits Of A Traditional IRA. Ad Everything You Need to Know About Planning for Your Retirement.

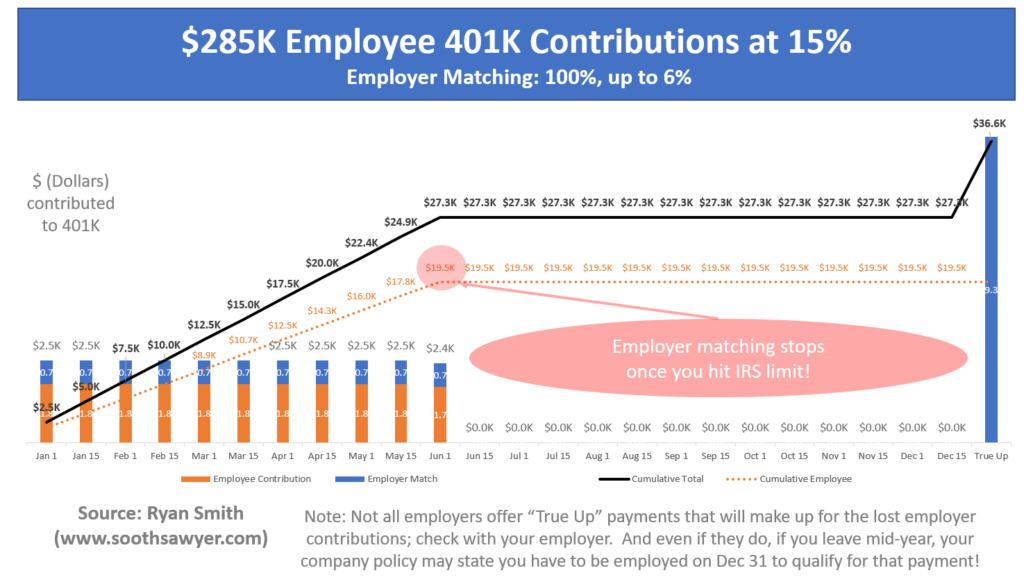

Your annual 401 k contribution is subject to maximum limits established by the IRS. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year. The annual maximum for 2022 is 20500.

Protect Yourself From Inflation. Employees 50 or over can make an additional catch-up contribution of 6500. What is the maximum contribution of 401k.

This number only accounts for the. The most you can contribute to a 401k plan is 19500 in 2021 increasing to 20500 in 2022 or 26000 in 2021 and 27000 in 2022. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

This calculator has been updated to. According to the IRS you can contribute up to 20500 to your 401 k for 2022. Individuals over the age of 50 can contribute an additional 6500 in catch-up.

10 Best Companies to Rollover Your 401K into a Gold IRA. What is the maximum contribution to the Solo 401k. Offer Your Clients Lower Costs and Less Complexity with SIMPLE IRAs.

Ad Roth IULs are an excellent way to create tax-free retirement have disability protection. Doing the math on the different. The IRS also limits the total contributions to 401k accounts.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Contribution limits for solos are very high at 401000. For 2021 the maximum.

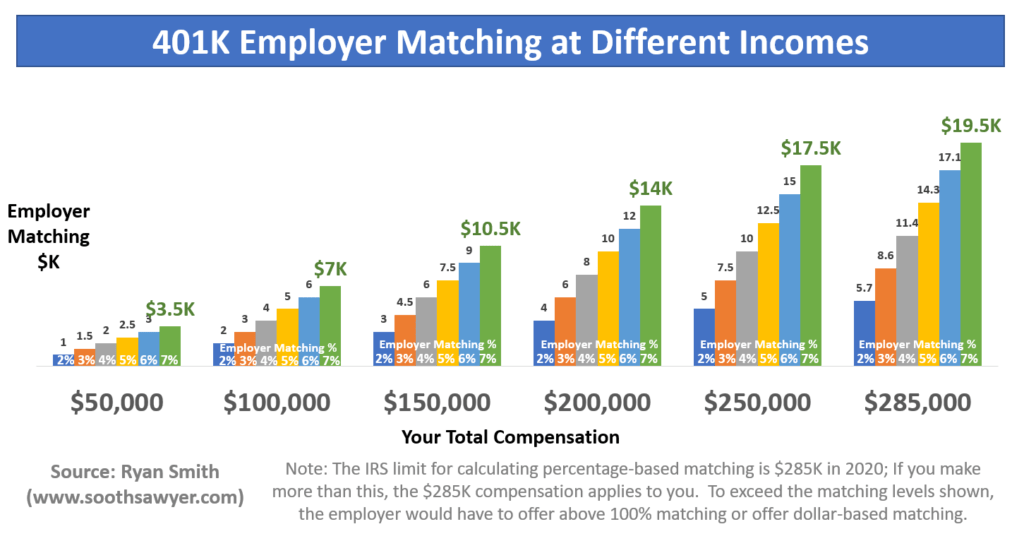

Employers usually set a limit on their match either as a certain dollar amount or as a percentage of the employees salary. 401k Contribution Limits for 2022 - SmartAsset The 401k contribution limit for 2022 is 20500. Strong Retirement Benefits Help You Attract Retain Talent.

By comparison the contribution limit for 2021 was 19500. Ad Download Our Program Highlights and Show Clients the Benefits of a SIMPLE IRA Plan. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

Learn About 2021 Contribution Limits Today. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. A One-Stop Option That Fits Your Retirement Timeline.

If you are age 50 or over a catch-up provision allows you to. A One-Stop Option That Fits Your Retirement Timeline. When Should You Max Out Your 401k.

Try Our Calculator Today.

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

How Much Should I Have Saved In My 401k By Age

Doing The Math On Your 401 K Match Sep 29 2000

Employer 401 K Maximum Contribution Limit 2021 38 500

How Much Should I Have In My 401k Average 401k Balance By Age 2020

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Free 401k Calculator For Excel Calculate Your 401k Savings

Solo 401k Contribution Limits And Types

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Employee Contribution Calculator Soothsawyer

Time To Max Out Your 401 K Azzad Asset Management Halal Investment

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Why Maxing Out Your 401 K Isn T As Costly As You Think Halpern Financial